COVID-19 Employer Options – April 2, 2020

April 2, 2020

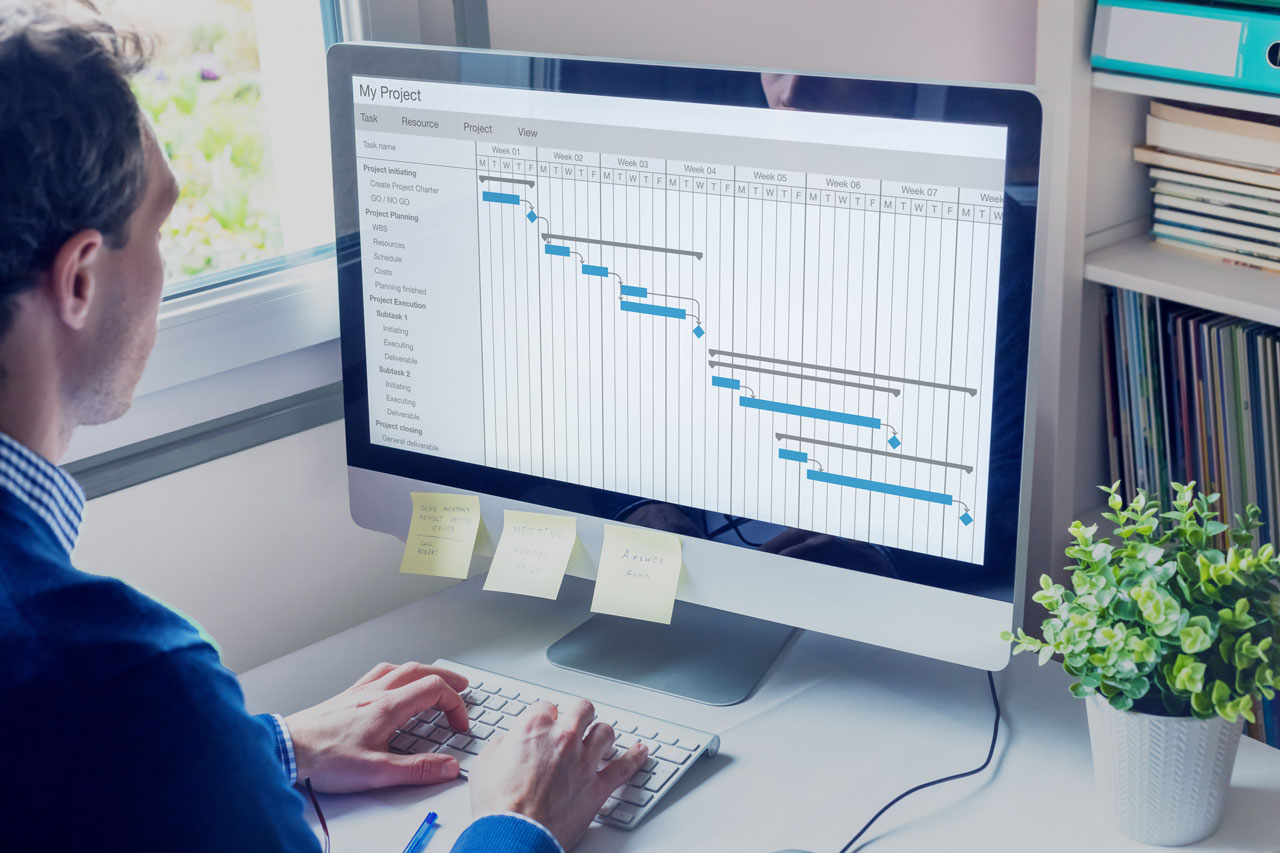

Are You Selecting the Right Technology?

April 8, 2020The Department of Labor issued temporary regulations for the Families First Coronavirus Response Act (FFCRA) on April 1, the date that the law went into effect. Here is a brief overview of what employers need to know:

- If a business is closed due to COVID-19 and no work is available, then the employee is not eligible for FFCRA leave.

- A “stay-at-home” order issued by any government authority does qualify as a quarantine for provisions of the FFCRA. This means, beginning April 1, employees who are unable to work due to a “stay-at-home” order are eligible for up to two weeks (80 hours or a part-time employee’s two-week equivalent) of Emergency Paid Sick Leave (EPSL) even if they are not sick IF there is work available for the employee. This leave is paid at 100% of their regular rate of pay, up to $511 daily and $5,110 total. Employees who were laid off, furloughed or terminated from their employment prior to April 1 are not eligible for EPSL.

- Employers may require employees to use accrued leave for the first two weeks of Expanded Family Medical Leave Act (EFMLA) if the employer’s policy (in effect prior to April 1) requires employees to use all accrued leave before going into leave without pay status. The EFMLA provides up to 12 weeks (two weeks unpaid, ten weeks paid at 2/3 of the employee’s regular rate of pay or at least minimum wage, up to $200 per day and $12,000 combined total) to provide childcare for the employee’s own minor child(ren) whose school/childcare provider is closed due to COVID-19. The FFCRA also allows employee to use the two weeks of EPSL for this reason if they choose but it is paid at 2/3 the employee’s regular rate of pay.

- Employers are eligible for payroll tax credits to cover certain costs (wages, qualified health plan expenses and employer’s share of Medicare taxes) related to providing employees with FFCRA paid leave. Records and documentation related to and supporting each employee’s leave will be required to substantiate the claim for the credits.

- Employees should submit a written request to their employer for FFCRA leave. This request should include:

- The employee’s name;

- The date or dates for which leave is requested;

- A statement of the COVID-19 related reason the employee is requesting leave and written support for such reason (school/childcare closure notice, “stay-at- home” order, documentation from medical provider, etc.); and

- A statement that the employee is unable to work, including by means of telework, for such reason.

- Employers should also retain documentation showing how the employee’s regular rate of pay and paid leave benefit was calculated. Please contact us at in**@**********ol.net if you would like more information.

An HR professional can help you with all of your human resources needs. From hiring the right employees, running background checks, creating employee handbooks that include anti-harassment policies and procedures, and so much more, Next Level Solutions can work with you to provide the services that you need to run your business.

Don’t risk being out of compliance or letting your employee handbook become obsolete; give us a call today to see how we can become your human resources partner.